Taken from CNBC’s Daily Open, our international markets newsletter — Subscribe today

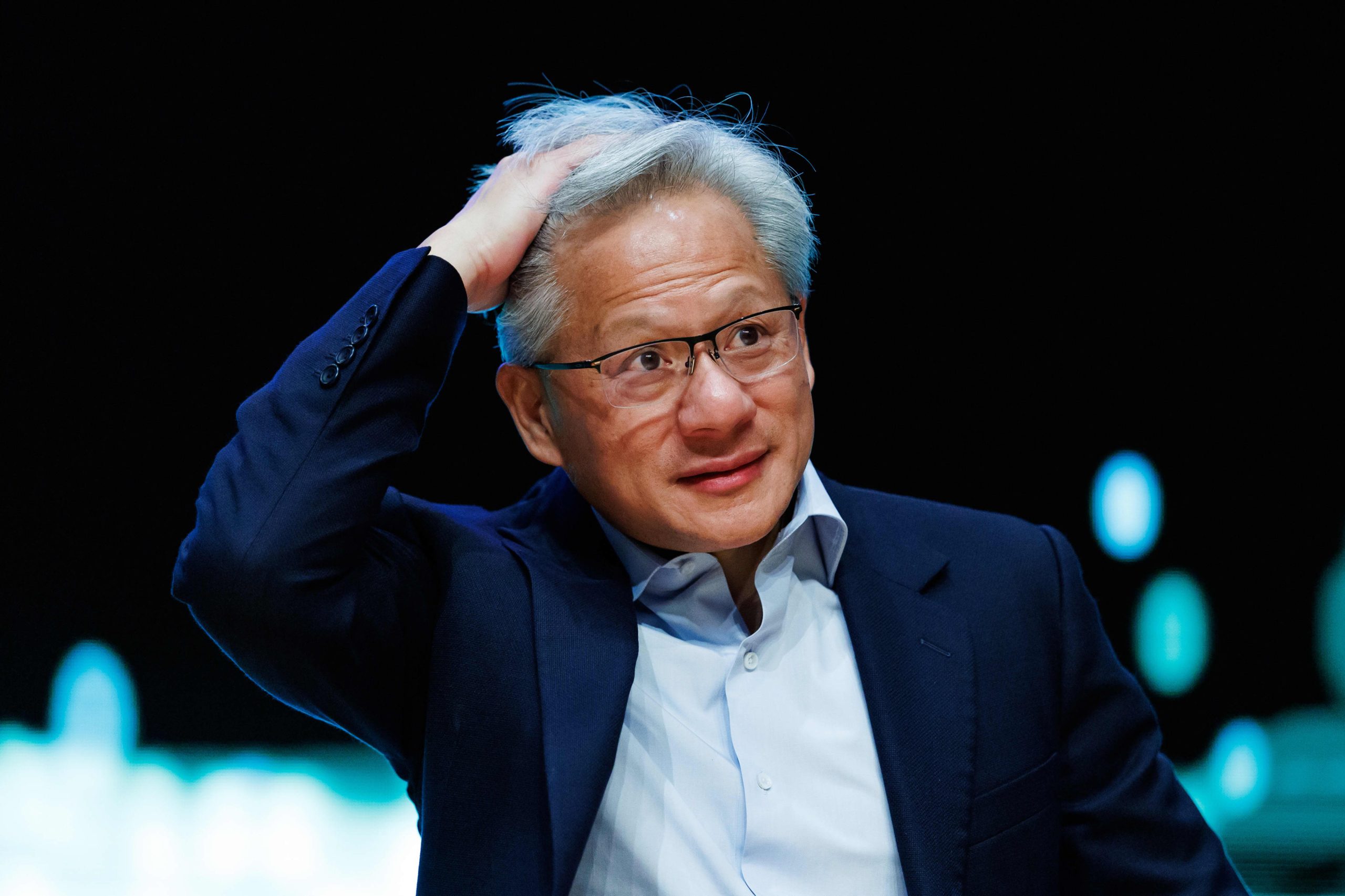

“There’s been a lot of talk about an AI bubble,” Nvidia CEO Jensen Huang told investors on an earnings call. “From our vantage point, we see something very different.”

Of course, this could be the regular sales pitch all CEOs have to do on earnings calls. Which leader is going to publicly put down their business model? Having said that, Huang might be intimating that, because of the insight Nvidia has into the artificial intelligence industry — such as precise sales figures, the relationships and deals still being forged, clients’ plans on utilizing data centers — the sum of the sector is more than its parts.

That could be hopeful thinking. And there was some uncertainty regarding Nvidia’s announced $100 billion investment in OpenAI.

But investors certainly cheered Huang’s statement and the chipmaker’s results. Shares of Nvidia popped more than 5% in extended trading, after its post-bell earnings announcement. Prior to that, shares rose 2.85% in regular trading, pushing up major indexes.

Regardless of what the AI industry and trade might look like in the future, from investors’ perspectives, Nvidia’s earnings are clearly something to celebrate for today.

What you need to know today

The S&P 500 snaps a four-day losing streak. Major benchmarks rose Wednesday stateside as investors returned to tech stocks, with AlphabetAsia-Pacific markets mostly rose Thursday as Asian chip stocks rallied on Nvidia’s blockbuster results.

Nvidia’s numbers beat forecasts. Fiscal third-quarter earnings and revenue were higher than Wall Street’s estimates, with net income rising 65% year on year to $31.91 billion. Nvidia’s guidance for sales in the current quarter also beat expectations.

The Fed is divided on a December cut. “Many” officials think interest rates do not need to be lowered further for the rest of the year, but “several” assessed a reduction could be “appropriate in December,” according to minutes of their October meeting.

Singapore’s bourse ties up with the Nasdaq. The partnership streamlines the process of attaining a dual listing in the U.S. and Singapore for companies with a market capitalization of more than 2 billion Singapore dollars (about $1.5 billion).

[PRO] Nvidia’s earnings shine but questions remain. Even though markets got a “pop the champagne moment,” as one analyst wrote, others are questioning the long-term viability of the AI business.

And finally…

China’s homegrown games capture overseas players as its cultural influence expands

From Nezha 2 to Labubu, it’s been quite a year for Chinese cultural exports. Now, one of the latest titles to hit the $189 billion global gaming market is also from China.

More than 2 million people played the martial arts video game “Where Winds Meet” within 24 hours of its overseas release this past weekend on PlayStation and PC, according to the game’s Chinese publisher NetEase — and China’s emerging soft power in games has captured the attention of wealthy investors in Saudi Arabia.

— Evelyn Cheng

International: Top News And Analysis

Read the full article <a href="Read More” target=”_blank”>here.