Japan stocks led gains in Asia on Friday as investors welcomed a truce between Washington and Beijing, following a meeting between President Donald Trump and his Chinese counterpart Xi Jinping.

They reached a trade deal of sorts during a high-stakes meeting in South Korea on Thursday, de-escalating a dispute over rare earth elements that had threatened to push the world’s two largest economies into a full-blown trade war.

“Both sides appear to be maintaining leverage for future negotiations by keeping these measures as bargaining chips,” said JPMorgan Asset Management’s global market strategist, Chaoping Zhu.

Japan’s Nikkei 225

Shares of Panasonic Holdings fell over 8% lowering its forecast for full-year operating profit by 13.5% on Thursday, blaming weaker earnings from its key energy unit, which supplies batteries to Tesla and other automakers.

South Korea’s Kospi added 0.5% to close at a fresh high of 4,107.5 following Thursday’s record. The small-cap Kosdaq rose 1.07% to 900.42.

South Korean tech shares rallied after U.S. chipmaker Nvidia announced it was collaborating with the South Korean government to expand the nation’s AI infrastructure, utilizing over a quarter-million Nvidia GPUs.

Internet services giant Naver, which is also part of the initiative through its subsidiary Naver Cloud, will also expand its AI capacity with over 60,000 Nvidia GPUs. Naver stock was up about 5%.

Hyundai gained 9.6% after Nvidia announced it was deepening its partnership with the automaker in autonomous vehicles, smart factories, and robotics, with a new AI factory powered by its latest Blackwell AI processors.

The two companies plan to deploy 50,000 of Nvidia’s Blackwell GPUs and invest about $3 billion in AI infrastructure in South Korea.

Australia’s S&P/ASX 200 ended the trading session flat at 8,881.9

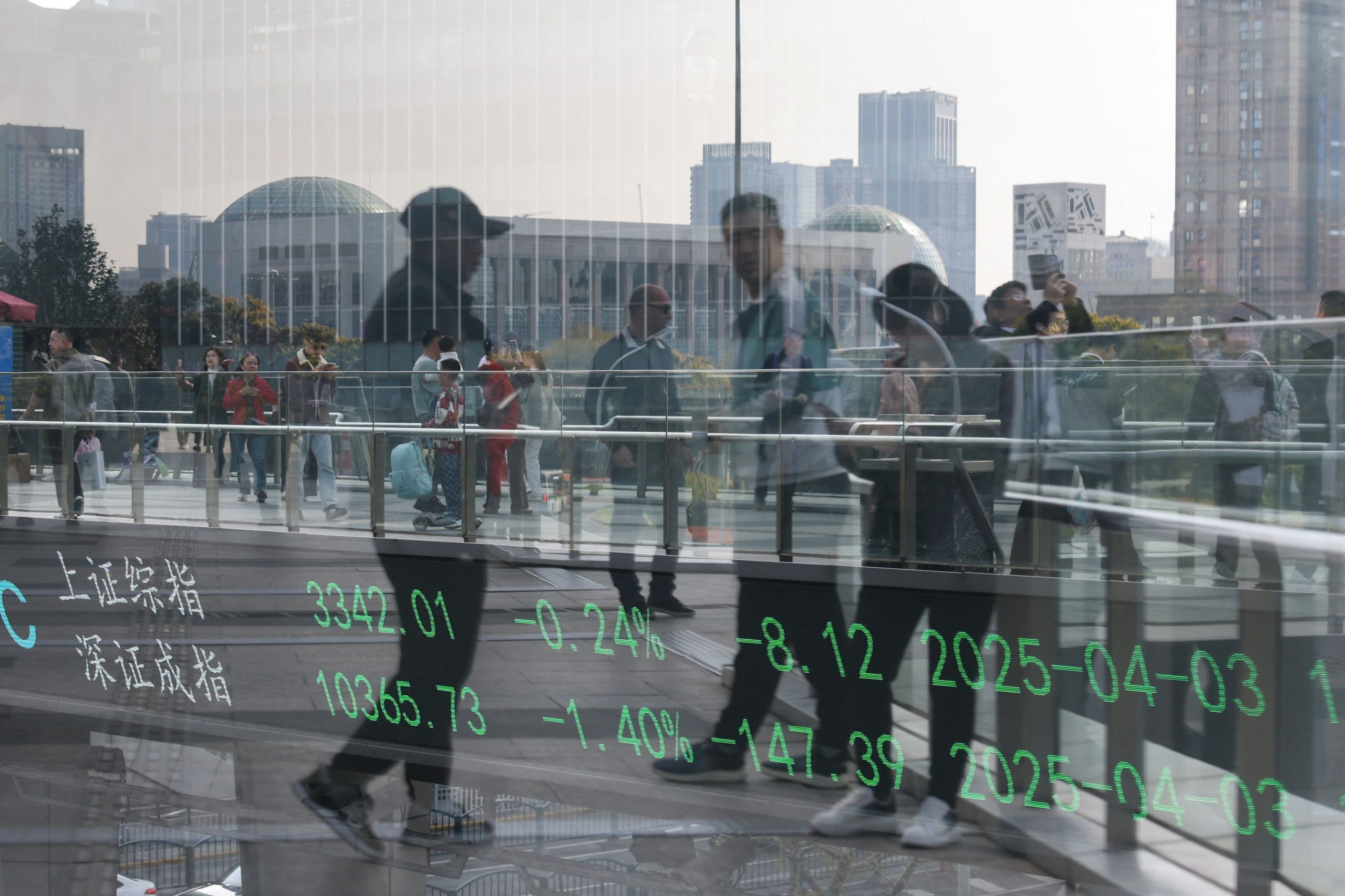

Hong Kong’s Hang Seng Index slid 1.43% to close at 25,906.65, while mainland China’s CSI 300 fell 1.47% to 4,640.67.

China’s manufacturing activity in October contracted more than expected, shrinking to its lowest since May, an official survey showed on Friday, as trade tensions with Washington reignited during the month.

The official manufacturing purchasing managers’ index came in at 49, data from the National Bureau of Statistics showed, missing economists’ expectations for 49.6 in a Reuters poll. A reading above the 50 benchmark indicates growth, while one below that suggests contraction.

The country’s manufacturing activity has remained in contraction since April, when U.S. President Donald Trump’s tariff campaign pressured Chinese factories and global demand.

Overnight in the U.S., all three major averages closed lower as investors digested a batch of Big Tech earnings. The S&P 500 dipped 0.99% to finish the day at 6,822.34, while the Nasdaq Composite dropped 1.57% to close at 23,581.14. The Dow Jones Industrial Average traded down 109.88 points, or 0.23%, to 47,522.12.

— CNBC’s Sean Conlon and Sarah Min contributed to this report.

International: Top News And Analysis

Read the full article <a href="Read More” target=”_blank”>here.