Taken from CNBC’s Daily Open, our international markets newsletter — Subscribe today

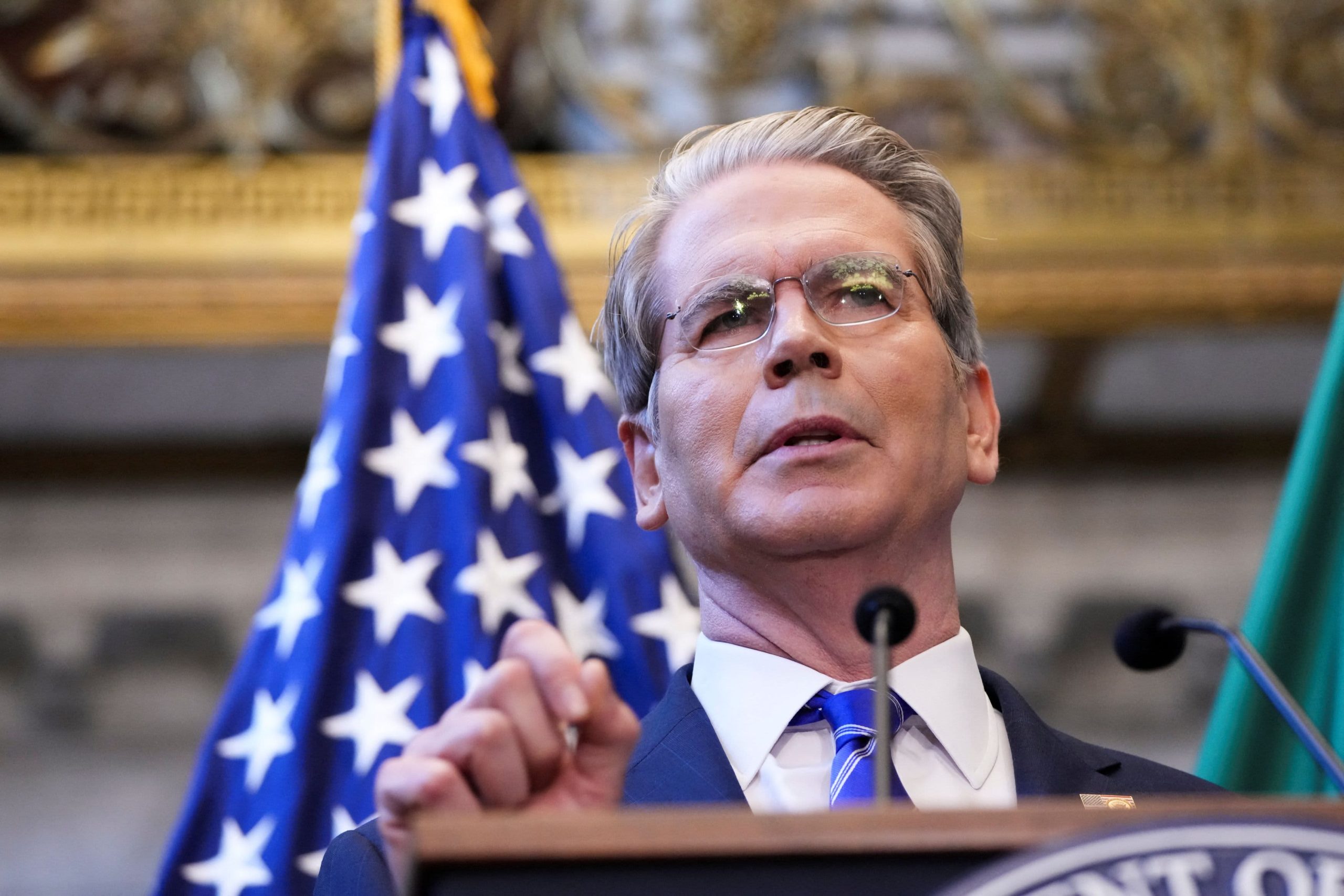

China has been using its dominance in the rare earth industry to slash prices, driving foreign competitors out, U.S. Treasury Secretary Scott Bessent told CNBC on Wednesday stateside in an exclusive interview. He characterized the country as having “a nonmarket economy.”

In response, the Trump administration will “exercise industrial policy” to set price floors in a range of industries. Price floors are a limit of how low suppliers can charge for goods or services. They are typically set above the market rate and are essentially a form of government price control.

Meanwhile, Bank of AmericaMorgan Stanley

And despite U.S. President Donald Trump’s continued saber-rattling at China on the trade front, traders don’t seem ready to let go of equities. On Wednesday stateside, the S&P 500Nasdaq CompositeRussell 2000

Whether traders continue pushing equities to new highs amid fractious trade relations with China will depend, in part, on the earnings of major technology companies such as Tesla and Intel due next week.

What you need to know today

White House will set price floors in industries. U.S. Treasury Secretary Scott Bessent told CNBC Wednesday stateside that the move is meant to combat China’s “nonmarket economy.” Bessent also rejected the idea that a stock market decline will change the U.S.’ stance toward China.

Tariffs are pushing prices higher, Fed report shows. The Fed Beige Book further noted that while some companies are keeping prices unchanged to remain competitive, others are “fully passing higher import costs along to their customers.”

Consortium purchases Aligned Data Centers. A consortium of investors including NvidiaMicrosoftBlackRocklargest global data center deal thus far, according to a release.

Stocks rise on strong earnings. The S&P 500 and Nasdaq Composite advanced Wednesday stateside after receiving a boost from Bank of America and Morgan Stanley’s massive earnings beats. Europe’s regional Stoxx 600 added 0.57%, led by luxury brands such as LVMHChristian Dior

[PRO] Small caps may continue rallying. The Russell 2000 is on track for its best week in 2025 — and there are signs that positive momentum could carry it even higher throughout the rest of the year.

And finally…

The Abu Dhabi investor that’s funding AI while trying to save TikTok — with help from Trump

Backed by Abu Dhabi’s sovereign wealth fund and launched in March 2024, MGX has emerged as a key source of capital as companies race to build out the enormous computing power needed to meet expected AI demand.

Certain transactions suggest a level of coziness with Trump.

Earlier this year, MGX reportedly provided $2 billion in funding to the crypto exchange Binance, using a cryptocurrency purchased from the Trump family’s World Liberty Financial. Its chairman Tahnoon bin Zayed Al Nahyan also visited Trump in the White House this spring to announce a $1.4 trillion investment in the U.S. over the next decade.

— Steve Kovach

Clarification: This story has been updated to reflect that the S&P 500 and Nasdaq Composite rose on Wednesday stateside. An earlier version did not specify which indexes rose.

International: Top News And Analysis

Read the full article <a href="Read More” target=”_blank”>here.