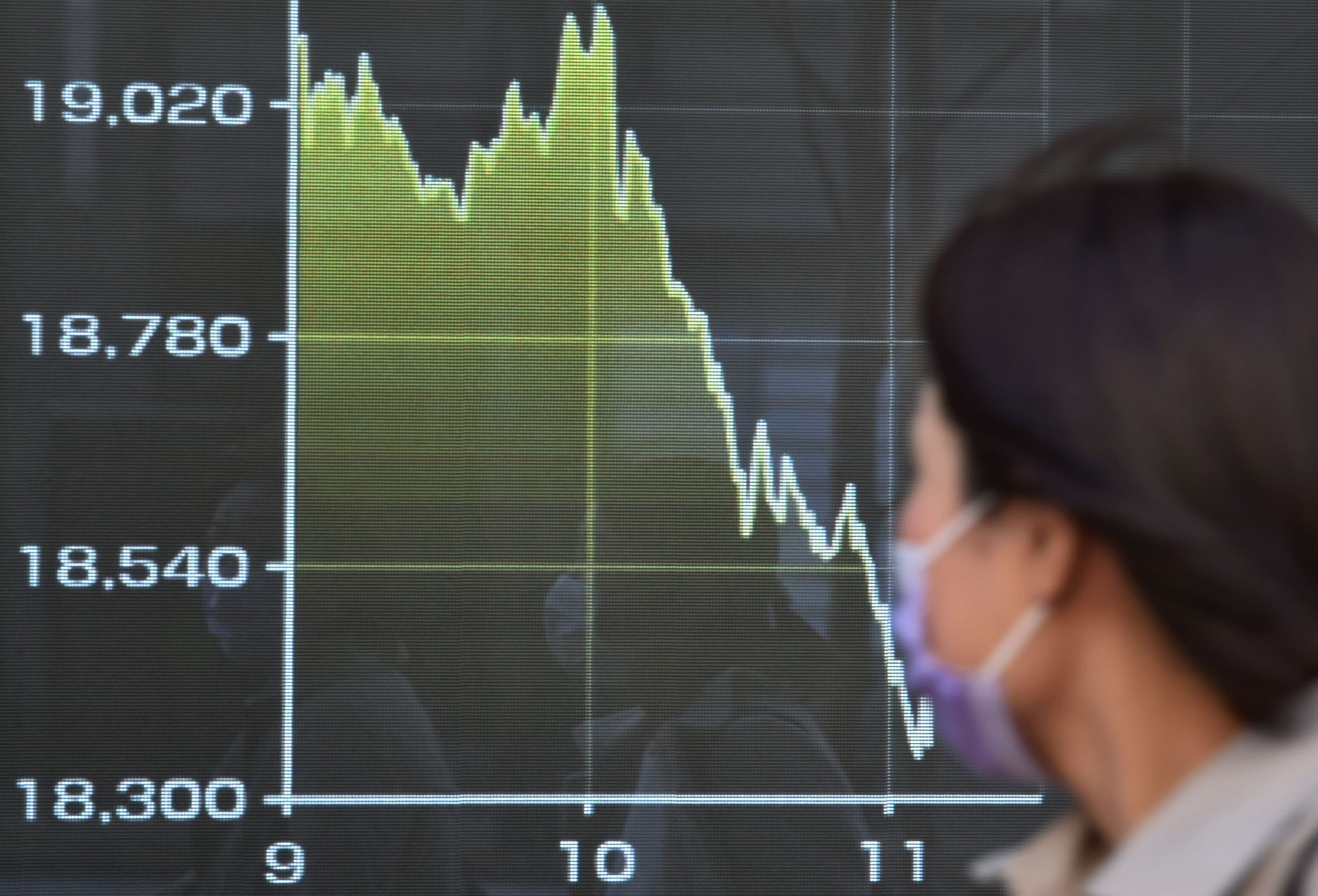

Japan’s benchmark Nikkei 225

One of Nikkei 255’s heavyweights, tech investment firm SoftBank Group, jumped past 10% to notch a second straight day of gains. It follows a Wall Street Journal report that OpenAI struck a roughly $300 billion, five-year cloud-computing deal with Oracle, citing sources familiar with the matter.

Oracle shares closed 35.95% higher Wednesday stateside after the cloud giant reported gobsmacking cloud demand numbers. Oracle now sees $18 billion in cloud infrastructure revenue in fiscal 2026, with the company calling for the annual sum to reach $32 billion, $73 billion, $114 billion and $144 billion over the subsequent four years.

“Expect a nice bump higher for Softbank… as investors joined the dots between this and Oracle’s connection, when only months ago Masayoshi Son and Larry Ellison stood together as Trump announced the Stargate program,” said Andrew Jackson, head of Japanese equity strategy at ORTUS Advisors.

SoftBank’s link to Oracle stems from their joint role in the high-profile Stargate program, a $500 billion U.S. initiative announced in January by U.S. President Donald Trump alongside OpenAI’s Sam Altman, Oracle’s Larry Ellison and SoftBank founder Masayoshi Son.

Energy and utilities stocks led gains on the Nikkei 225. Mitsui Mining and Smelting rose more than 5% while electrical components manufacturer Fujikura traded 4% higher. Meanwhile, the Topix index reversed course to climb 0.2%.

South Korea’s Kospi

Over in Australia, the ASX/S&P 200 declined 0.29% to end the day at 8,805.

Hong Kong’s Hang Seng Index

India’s benchmark Nifty 50 rose 0.13%, while the Sensex index was up 0.15%.

U.S. equity futures were little changed in early Asian hours, as Wall Street awaited a key consumer inflation gauge for August due out Thursday morning stateside.

Overnight stateside, most of the key U.S. benchmarks rose to hit new record closing highs after the latest producer price index data showed that inflation was cooling.

The broad market S&P 500 finished up 0.3% at 6,532.04, a record close for the index. It had risen about 0.7% at its peak to 6,555.97, scoring a new all-time intraday high as well. The Nasdaq Composite edged up 0.03% to end at 21,886.06, likewise notching a closing high after hitting an all-time intraday high before its afternoon pullback.

The Dow Jones Industrial Average lost 220.42 points, or 0.48%, to finish at 45,490.92, bogged down by a decline in Apple shares as the latest iPhone announcement failed to impress investors.

— CNBC’s Sean Conlon, Ashley Capoot, Chris Eudaily and Lisa Kailai Han contributed to this report.

International: Top News And Analysis

Read the full article <a href="Read More” target=”_blank”>here.