U.S. Treasury yields jump 6 to 8 bps amid shocking multi-billion outflows originally appeared on TheStreet.

Stablecoins pegged to the U.S. dollar have begun influencing yields on the U.S. Treasury bills, as per a working paper published by the Bank for International Settlements (BIS) on May 28.

Stablecoins are cryptocurrencies that strive to keep their prices stable by being linked to a fiat currency like the USD or a commodity like gold. USD-pegged stablecoins, which dominate the segment, are mostly backed by U.S. Treasury securities.

Considered one of the world’s safest investments, these securities are debt instruments issued by the U.S. government to raise money. When you buy one, you’re essentially lending money to the government in return for yields.

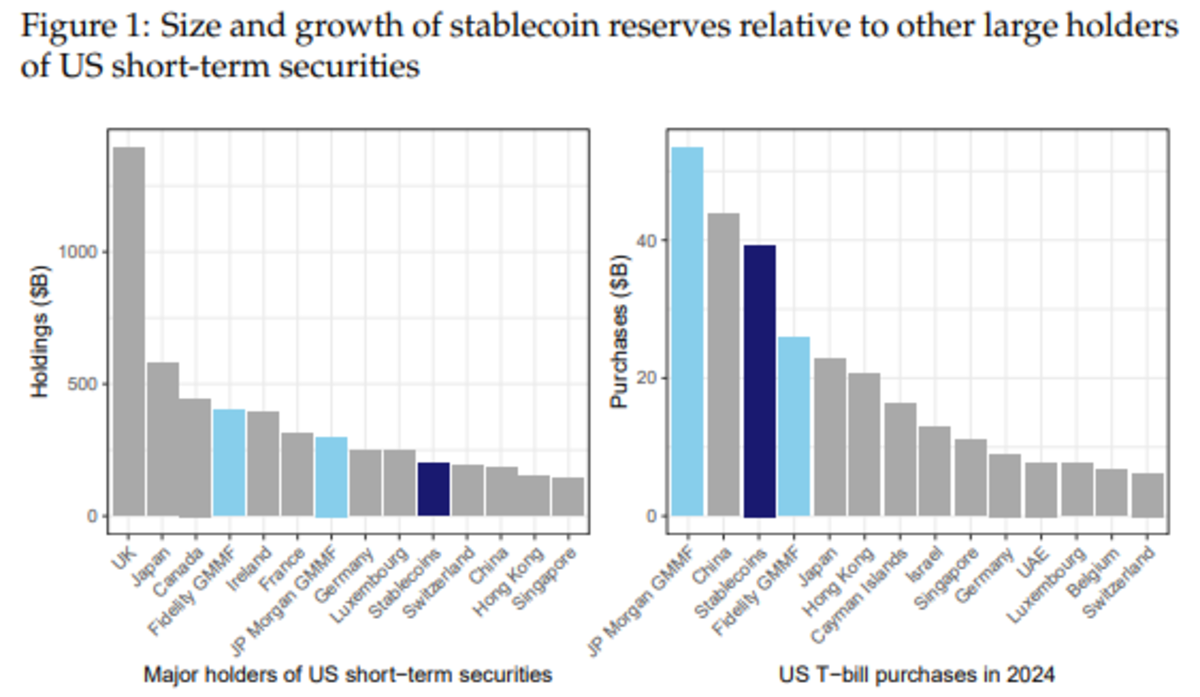

Notably, the USD-pegged stablecoins purchased nearly $40 billion in T-bills in 2024, even eclipsing countries like Japan, Singapore, and Germany.

The BIS paper says the surge and dip in the demand for USD-pegged stablecoins have evidently been influencing yields on 3-month Treasury bills.

Join the discussion with CryptoWendyO on Roundtable here.

As per the empirical analysis based on daily data during January 2021 to March 2025, BIS says an inflow of $3.5 billion into stablecoins is associated with 3-month T-bill yields falling by up to 2-2.25 basis points (bps) within 10 days.

Outflows into stablecoins tend to have a quantitatively larger impact on Treasury yields than inflows, the paper highlights. For example, an outflow of the same magnitude from stablecoins is associated with 3-month T-bill yields soaring by 6-8 bps.

The paper didn’t find the stablecoin flows impacting yields on long-term, say 2-year and 5-year, Treasury instruments. However, there is limited evidence of a spillover effect on the 10-year debt yields.

The stablecoin market is worth more than $265 billion at the time of writing; Tether’s USDT and Circle’s (NYSE: CRCL) USDC are the largest stablecoins. The BIS paper notes that USDT flows impact yields the most, with an average contribution of 70% on T-bill yields. USDC flows come next with a 19% contribution on yields.

U.S. Treasury yields jump 6 to 8 bps amid shocking multi-billion outflows first appeared on TheStreet on Jul 28, 2025

This story was originally reported by TheStreet on Jul 28, 2025, where it first appeared.

Terms and Privacy Policy

Yahoo News – Latest News & Headlines

Read the full article .