At the U.S. Capitol on May 13, guests at a festive dinner celebrated an anniversary that’s not on any official calendar, but it should be.

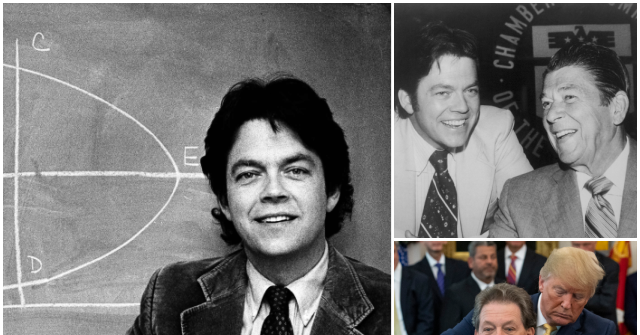

Back on September 13, 1974, a young economist, Arthur Laffer, was trying to illustrate a point about the optimum tax rate—the rate that optimized both tax revenue and economic growth. Converting his rapid stream of words into a single picture, Laffer drew a convex shape on the only thing handy: a restaurant napkin.

Economist Arthur Laffer stands before a chalkboard drawing of his famous Laffer curve, circa 1981. (AP Photo)

There are two tax rates, Laffer argued, at which the government gets zero revenues: zero percent and 100 percent. At a 100 percent tax rate, of course, the after-tax return falls to zero; and so there’s no reason to work or otherwise generate income. Yet somewhere in between zero and 100 is the optimum rate for producing revenue and growth. Laffer argued that current rates, then up to 70 percent, were too high and thus depressing revenue. So, if we could cut tax rates we would actually increase revenue (and growth).

Interestingly, Laffer himself never claimed credit for this insight. In the 14th century, the Arab philosopher Ibn Khaldun had made the same point; so, too, had later thinkers, including Adam Smith and John Stuart Mill. Indeed, as recently as 1962, President John F. Kennedy declared, “It is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the rates now.”

Yet Laffer’s contribution was nonetheless profound: He distilled all this wisdom into a single pithy visualization. Indeed, Laffer with the help of others, including the late Jude Wanniski who was the first to dub it the Laffer Curve—expanded this vision into a school of thought focused on productivity and abundance, which became known as supply-side economics.

Republicans and Democrats Resisted Supply-Side Economics

Yet as with any new idea, the guardians of the old idea were suspicious, even hostile. Although Kennedy, a Democrat, had embraced the essence of supply-side thinking—and the economy had boomed after his tax-rate cut was enacted in 1964—most Democrats were opposed.

Why? They just couldn’t bring themselves to embrace an idea that made it seem as if the rich were getting off easy. “Social justice” was better served by “soaking the rich,” they said, even if that meant tax revenues—and economic growth overall—would decline. Indeed to this day, most Democrats are ensorcelled by such thinking.

As for Republicans, the idea that cutting taxes would increase revenue was for many of them just too hard to understand. Better, they said, to keep revenues up and so close the deficit. The fact that Laffer and his allies were saying cut tax rates—with the point being that tax revenues would actually rise—was lost on these elephant-brains, as was the reality that if growth was slow, the deficit would never close.

Indeed, by the late 1960s, the two parties had settled into a strange anti-growth consensus; higher taxes and heavier regulation. The result was predictable: economic growth sputtered, even as inflation soared.

In the midst of the depressed decade of the 1970s, Laffer drew his famous curve. Then, with his characteristic zeal, Laffer persuaded many Republicans and some Democrats that tax-rate reductions would get the economy out of its funk.

Reagan Changed the Paradigm

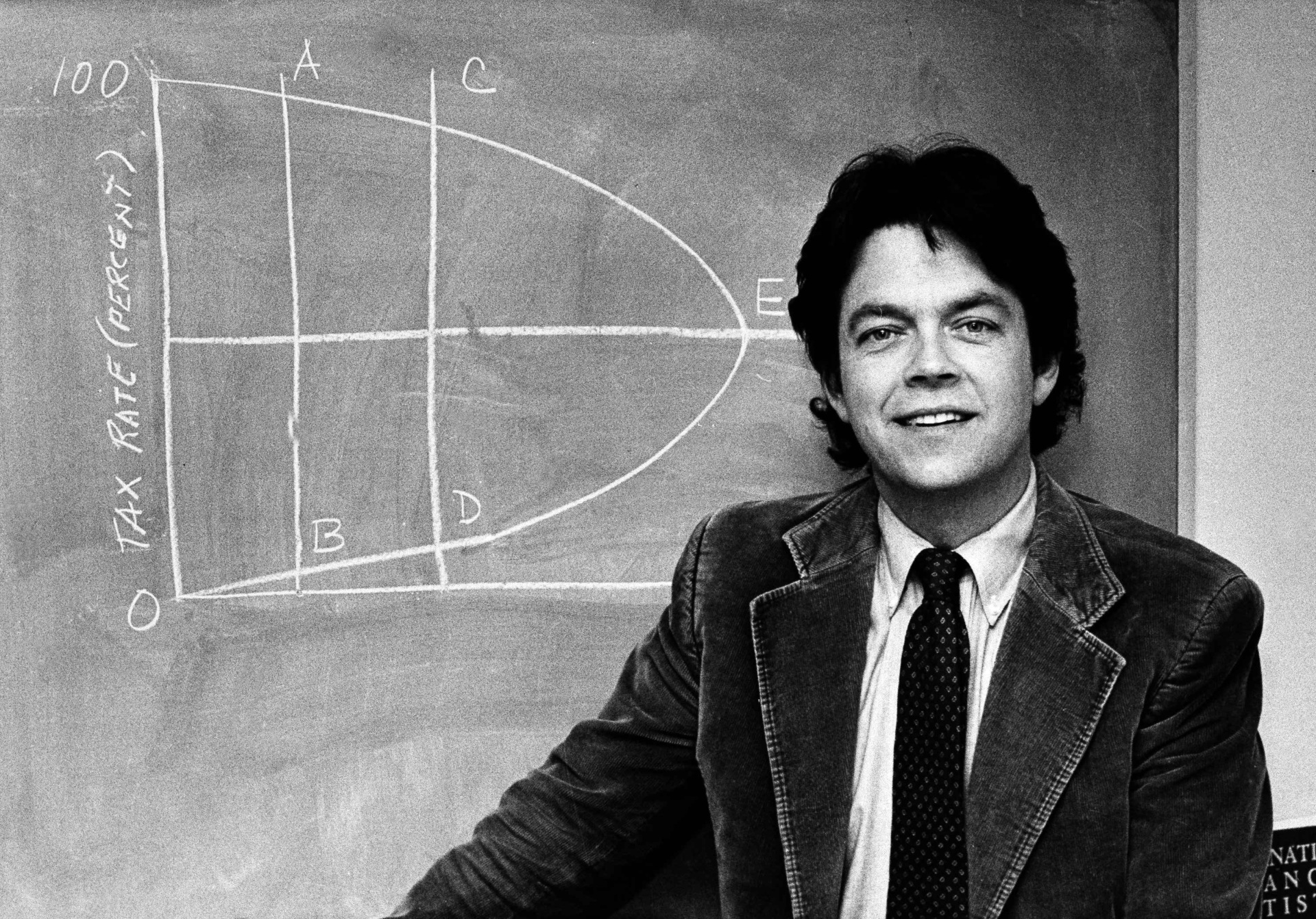

The greatest of these new allies was Ronald Reagan. As the 40th president from 1981 to 1989, he cut tax rates across the board; the top personal rate fell 42 points, and the corporate rate fell 12 points. Of course, the economy boomed: inflation and unemployment fell, while real GDP grew by a third.

Economist Arthur Laffer (left) and former California Governor Ronald Reagan enjoy an anecdote at a businessmen’s conference in June 1978. (Bettmann/Getty Images)

Over the half a century since, with some adjustments up and down, rates have stayed low. Result: a long boom. Real per capita GDP is two-and-a-half times what it was in 1974.

Now, President Donald Trump is taking the lead on a new round of pro-growth policies—holding the line on taxes, pushing deregulation and energy dominance, making epic business deals. And so new capital and investment is rushing into the U.S.—some $12 trillion at last count. And Trump has been fully mindful of Laffer’s contribution. In 2019, he awarded him the Presidential Medal of Freedom.

President Donald Trump presents the Presidential Medal of Freedom to economist Arthur B. Laffer, the “Father of Supply-Side Economics,” on June 19, 2019, in the Oval Office. (Official White House Photo by Joyce N. Boghosian)

So, yes, there was much to celebrate at the Capitol. Laffer, now 84, was hosted by Steve Moore of Unleash Prosperity, a group dedicated to pro-growth policies. Speaker of the House Mike Johnson (R-LA) lauded Laffer, as longtime allies—including Kellyanne Conway, John Fund, Rep. Darrell Issa (R-CA), Sen. Rand Paul (R-KY), Jimmy Kemp, Lisa Nelson, Richard Rahn, Peter Roff, Avik Roy, and Judy Shelton—nodded in agreement.

Still, amidst the glad toasting, there was seriousness of purpose. Laffer himself, still brimming with energy and insight, laid out both lessons learned over the least half-century and the steps ahead, starting with the Trump tax bill now before Congress. Among the objectives: reducing the corporate income tax rate to a level lower than critical competitors, most notably, China.

Looking further ahead, there’s the broader and better future to be shaped. Thanks in no small part to the Laffer Curve—that eureka moment in 1974 that deserves permanent commemoration—and supply-side thinking overall, we should have faith that this is a battle of ideas we can win.

Oh, and one more thing: Art Laffer deserves a Nobel Prize. No living person has done more for economic growth, opportunity, and human flourishing.

—Today’s Breitbart Business Digest was written by James P. Pinkerton.

Breitbart News

Read the full article .