Nvidia reported fourth-quarter earnings after the bell on Wednesday that beat Wall Street expectations. The company also provided strong guidance for the current quarter

The company’s report and guidance signals that that the chipmaker is confident it will be able to continue its historic run of growth driven by AI well into 2025. Shares were flat in extended trading.

Here’s how the company did, compared with estimates from analysts polled by LSEG:

- Revenue: $39.33 billion vs. $38.05 billion estimated

- Earnings per share: $0.89 adjusted vs. $0.84 estimated

Nvidia said that it expected about $43 billion in first-quarter revenue, plus or minus 2%, versus $41.78 billion expected per LSEG estimates. The first-quarter forecast implies year-to-year growth of about 65% from a year earlier, a slowdown from 262% annual growth in the same period a year prior.

Chief Financial Officer Colette Kress said the company expects “a significant ramp” of sales of Blackwell, its next-generation AI chip, in the first quarter.

Net income during the quarter rose to $22.09 billion, or 89 cents per diluted share, versus $12.29 billion or 49 cents per share in the year ago period.

Nvidia reported a 73% gross margin in the quarter, which was down three points on an annual basis. The company said that the decline in gross margin was due to newer data center products that were more complicated and expensive.

Revenue continues to surge at Nvidia as the company continues to ride the AI boom with its data center graphics processors, or GPUs, which comprise the vast majority of the market for AI accelerators. Nvidia’s revenue in the quarter rose 78%, and full fiscal-year revenue for Nvidia rose 114% to $130.5 billion.

However, Nvidia’s growth is slowing as the company becomes larger. During the fourth-quarter of fiscal 2024, Nvidia sales more than tripled.

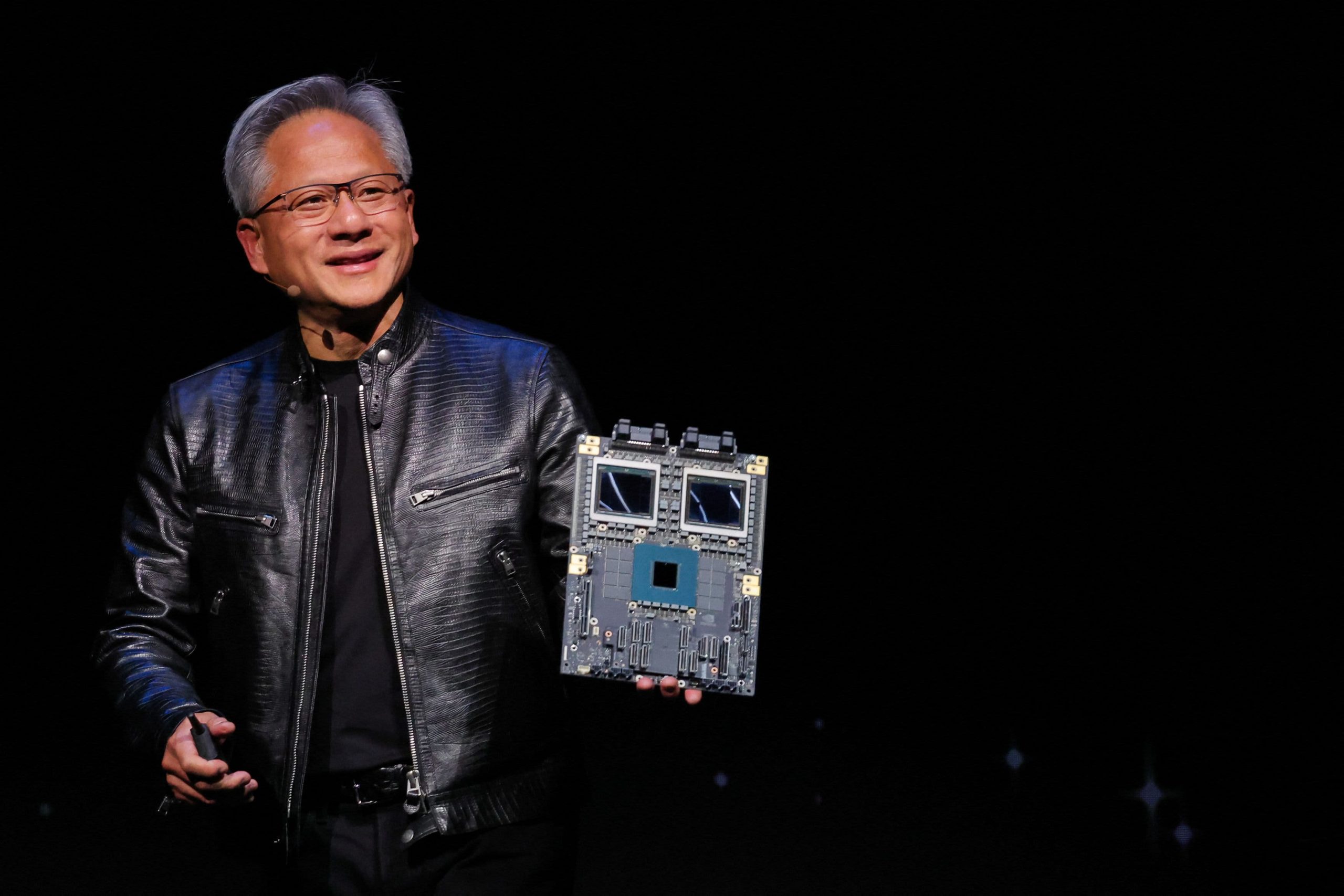

Much of the focus this calendar year is on how quickly the company can ship its next-generation AI processors, called Blackwell.

Nvidia said that it had $11 billion in Blackwell revenue during the fourth quarter. Nvidia CEO Jensen Huang said that demand for Blackwell is “amazing” in a statement, and Kress called it “the fastest product ramp in our company’s history.”

“Blackwell sales were led by large cloud service providers which represented approximately 50% of our Data Center revenue,” Kress said in a statement.

Blackwell sales, as well as sales of the previous generation Hopper AI chips, are reported in the company’s data center business. That unit now represents 91% of the company’s total sales, up from 83% a year ago and 60% in the same period of 2023. In total, data center revenue has increased about tenfold in the past two years.

Nvidia said that it had $35.6 billion in data center revenue in the fourth-quarter, which was up 93% on an annual basis. That also surpassed StreetAccount expectations of $33.65 billion.

Nvidia officials told investors that while its chips were previously used to develop, or train, artificial intelligence, its new chips like Blackwell would be used to deliver AI software, a process often called inference.

Kress also addressed investor concerns that efficient models like DeepSeek’s R1 may limit the need for additional Nvidia chips. New ways of running AI models that ask the AI to generate additional information to “think” through responses could require as much as 100 times the amount of Nvidia chips, she said.

“Long-thinking, reasoning AI can require 100 times more compute per task compared to one shot inferences,” Kress said.

“The vast majority of our compute today is actually inference,” Nvidia CEO Jensen Huang told investors. He said that next-generation AI algorithms could even need millions of times the current amount of computing capacity.

Huang also addressed questions about whether Nvidia’s business could be threatened by custom chips being developed by technology companies like Amazon, Microsoft and Google.

“Just because the chip is designed doesn’t mean it gets deployed,” Huang said.

The company’s data center business this quarter also included $3 billion in sales for the company’s networking parts, which are used to connect hundreds of thousands of GPUs together. However, while Nvidia had signaled that networking was a growth opportunity for the company, networking sales were down 9% from a year ago.

The company’s gaming business, which includes graphics processors for playing 3D games, reported $2.5 billion in sales versus StreetAccount expectations of $3.04 billion. Nvidia’s graphics sales actually declined 11% on an annual basis. The company announced new graphics cards for consumers during the quarter that share the same Blackwell architecture as the company’s AI chips.

One of the company’s growth categories is its business selling chips for cars and robots. Nvidia said on Wednesday that it had $570 million in automotive sales during the quarter, which is a small fraction of the company’s AI business, but which represents a 103% rise on a year-over-year basis.

Nvidia said it spent $33.7 billion on share repurchases in its fiscal 2025.

International: Top News And Analysis

Read the full article <a href="Read More” target=”_blank”>here.